Vendor card acceptance

Our vendor card acceptance tool helps customers determine which of their vendors will accept card payments. By putting more spend on their card, they can earn more rewards.

My Role

Lead Designer

Team

Amy Higgins, Design Manager

Brittany Micek, Content Designer

The journey

-

Card Accept tool launches in early 2024

This internal associate tool allows relationship managers to help their medium to high-touch customers identify card-accepting vendors.

-

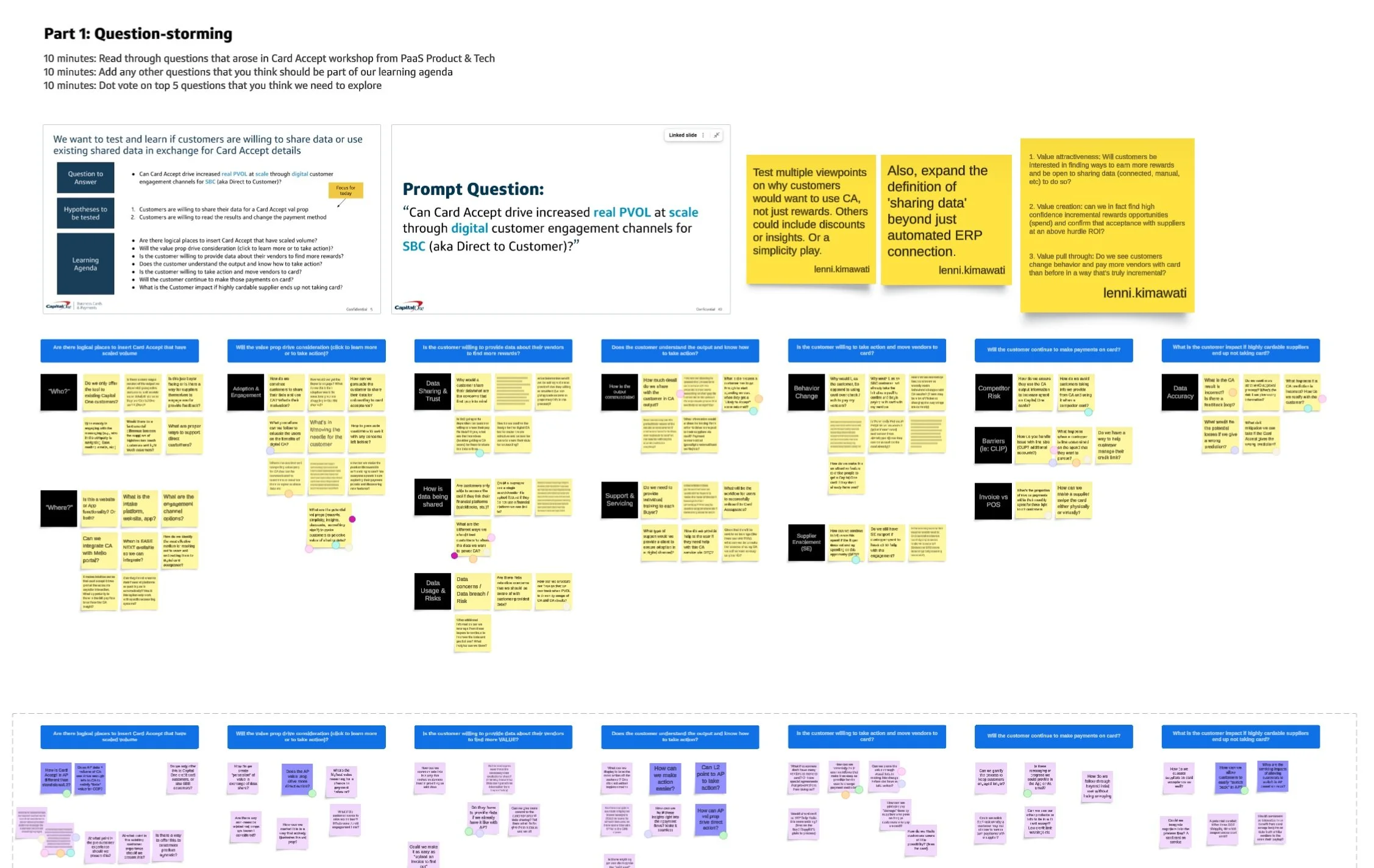

Strategy begins for direct-to-consumer late 2024

A small group made of cross-functional team members come together to workshop how we can bring card accept directly to our digital, low-touch customers.

-

Incremental MVP testing launches in 2025

The outcome of the 2024 workshops and strategy efforts was a push for incremental testing with Q2 interest tests and a single search MVP tool to be released in Q3.

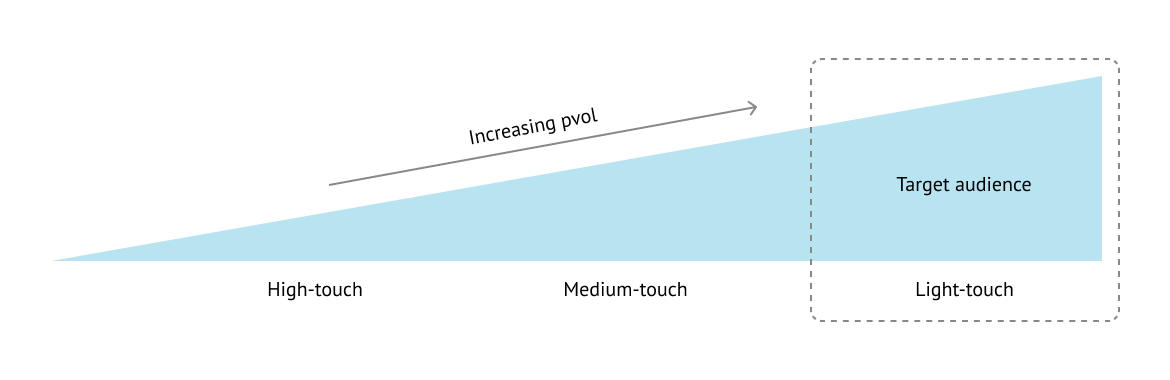

Our target audience

While we have an internal card accept tool that can be used by field associates for our high and medium-touch customers, they only represent 25% of purchase volume (pvol) for the business sector. Bringing a card accept tool to our self-service, light-touch customers allows us to target an estimated $120B in spend.

High-touch

Purchase volume = ~$12B

Commercial card customers that are provided with “white-glove” services by Customer Success Managers.

Medium-touch

Purchase volume = ~$28B

Commercial card and small business customers that are supported by Relationship Managers.

Light-touch

Purchase volume = ~$120B

Small business customers that are not supported by the field and are largely self-service.

What we know about our customers

The team participated in empathy mapping to better understand and align on customer attitudes and behaviors related to payment habits, data-sharing, and rewards… all of which are variables that play a large part in what would be our vendor card accept experience.

Our customers…

✔︎ Want to earn more rewards

✔︎ Have concerns around security

✔︎ Need to see the value of their data-sharing

✔︎ Have mixed feelings about manual vs automated processes

What we’re looking to learn

With our MVP pilot experience, the team is hoping to uncover several learnings:

🧭

Motivation to explore

Does the rewards value proposition motivate customers to look into the card accept tool?

Measured by impressions & click-through🧑💻

Willingness to share

Are customers comfortable with sharing their vendor data with Capital One?

Measured by engagement (searches)💳

Ability to drive pvol

Are we providing customers with enough information to convert payments to card?

Measured by payments to cardThe MVP design

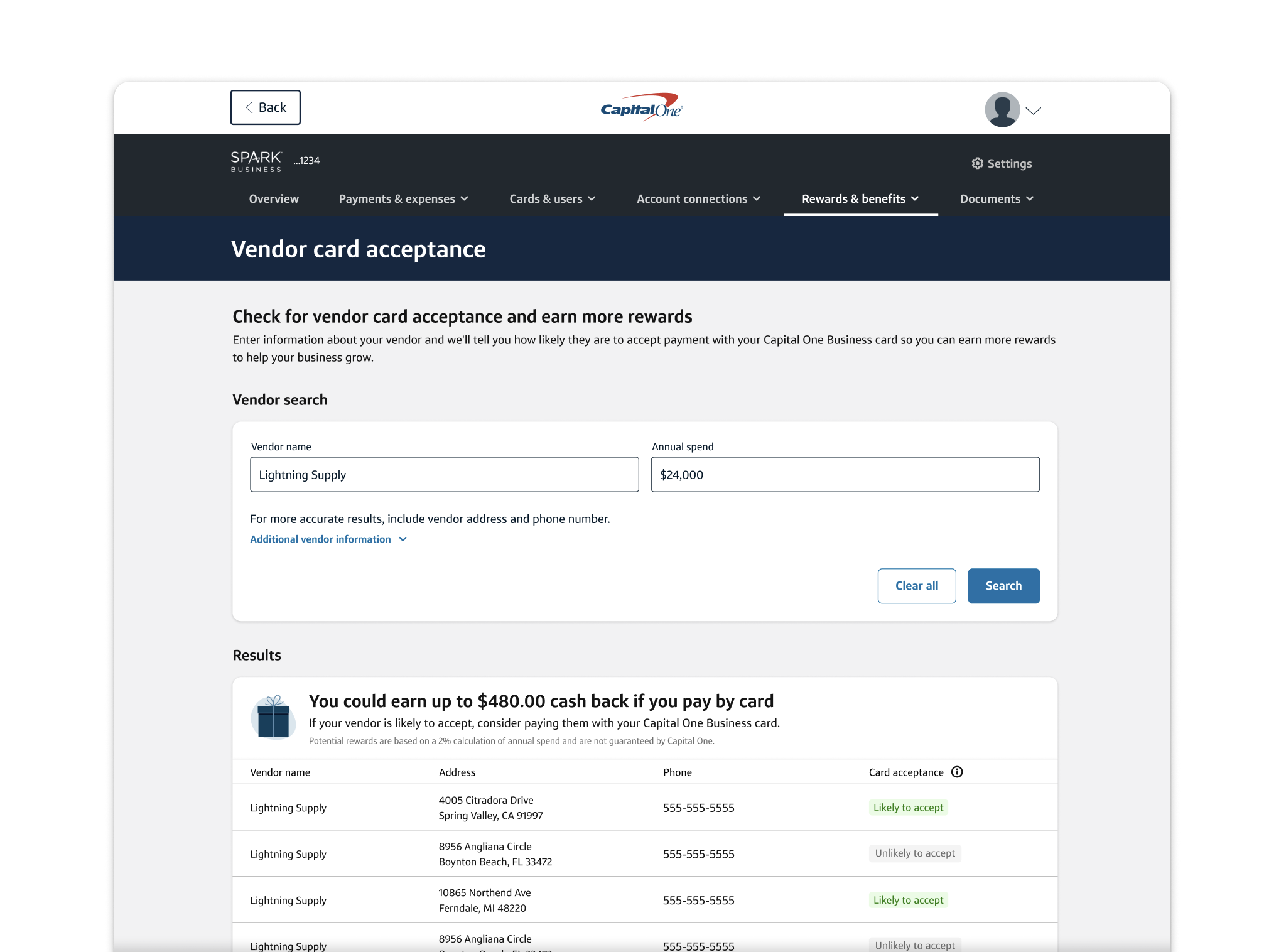

Our MVP design brings the vendor search functionality from our internal tool directly to customers to allow them to search for their own vendors.

Within the results, we highlight the rewards potential and provide next steps to guide customers towards a switch to card payment.

Another example of a result, where the content is altered to provide appropriate guidance.Relevant resources provide our customers with pathways elsewhere in the platform and encourage use of other products, such as Accounts Payable, to help manage their business’s finances.

Testing our MVP

I tested the MVP design with 6 customers to assess usability and comprehension of the search tool and, overall, the reaction was positive.

Key takeaways

The tool is easy to use and understand

The reactions to the rewards potential shown in the results was very positive, reinforcing our value proposition

All participants understood the card acceptance results and the next steps provided.

“I think it’s a great, unique idea and I do think people would like to use it. I would like to use it.”

While the MVP tool was in development, we launched two in-market tests…

-

Test 1: Accounts Payable

To get initial reads on interest in a vendor card acceptance tool, I collaborated with the Accounts Payable team to design a widget for placement within their Action Center.

-

Test 2: Business Dashboard

Within the Rewards tile on the new business dashboard, I collaborated with the dashboard team and designed a multi-variant test to compare interest in a search tool vs. an ERP connection tool to receive card acceptance results.

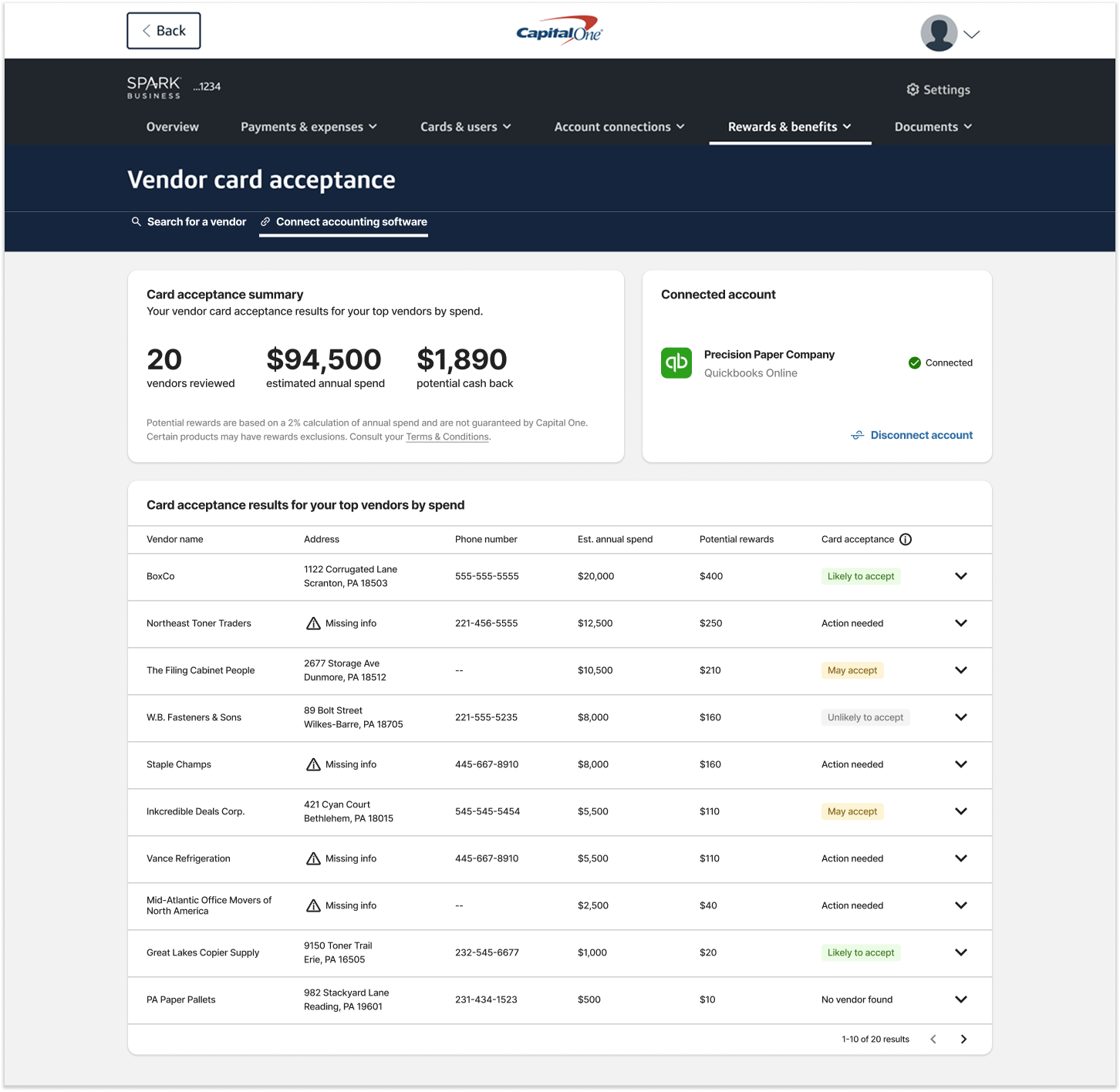

Another way to receive card accept results…

While the development of the single search tool was underway, the team partnered with Data Integrations to provide another pathway for customers to receive card acceptance information, especially those that had larger businesses with numerous vendors.

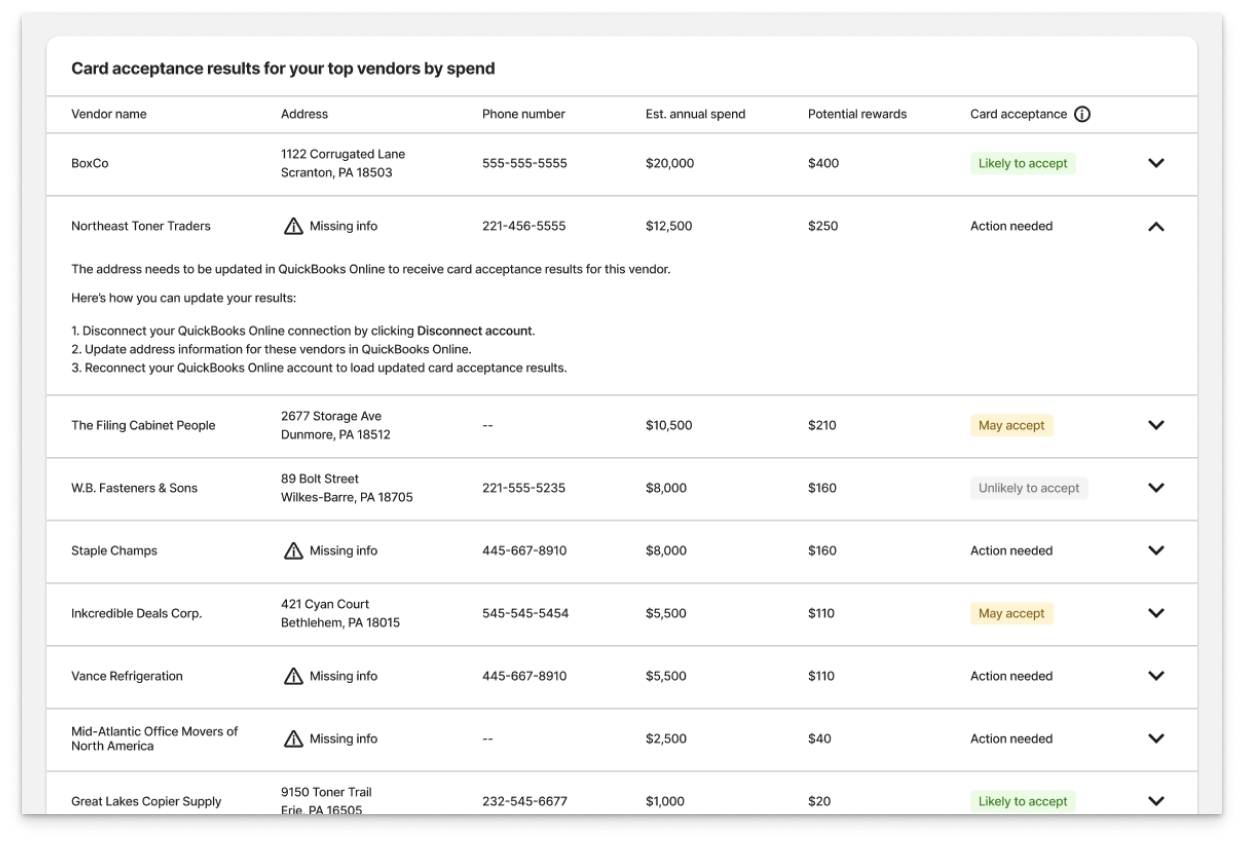

I led the design of the accounting software (ERP) pilot experience, which allows customers to connect their ERP (QuickBooks Online for MVP) to receive card acceptance results for their top 20 vendors based on spend.

Some challenges we needed to solve for…

Load time

⚠️ Problem:

With the amount of time it takes to ingest the vendor data, run it through our card acceptance tool, then return the results, it takes too long to load all vendor results.

🧠 Solution:

To start, we’d launch the tool to load the top 20 vendors by spend to allow customers to maximize their highest rewards potential.

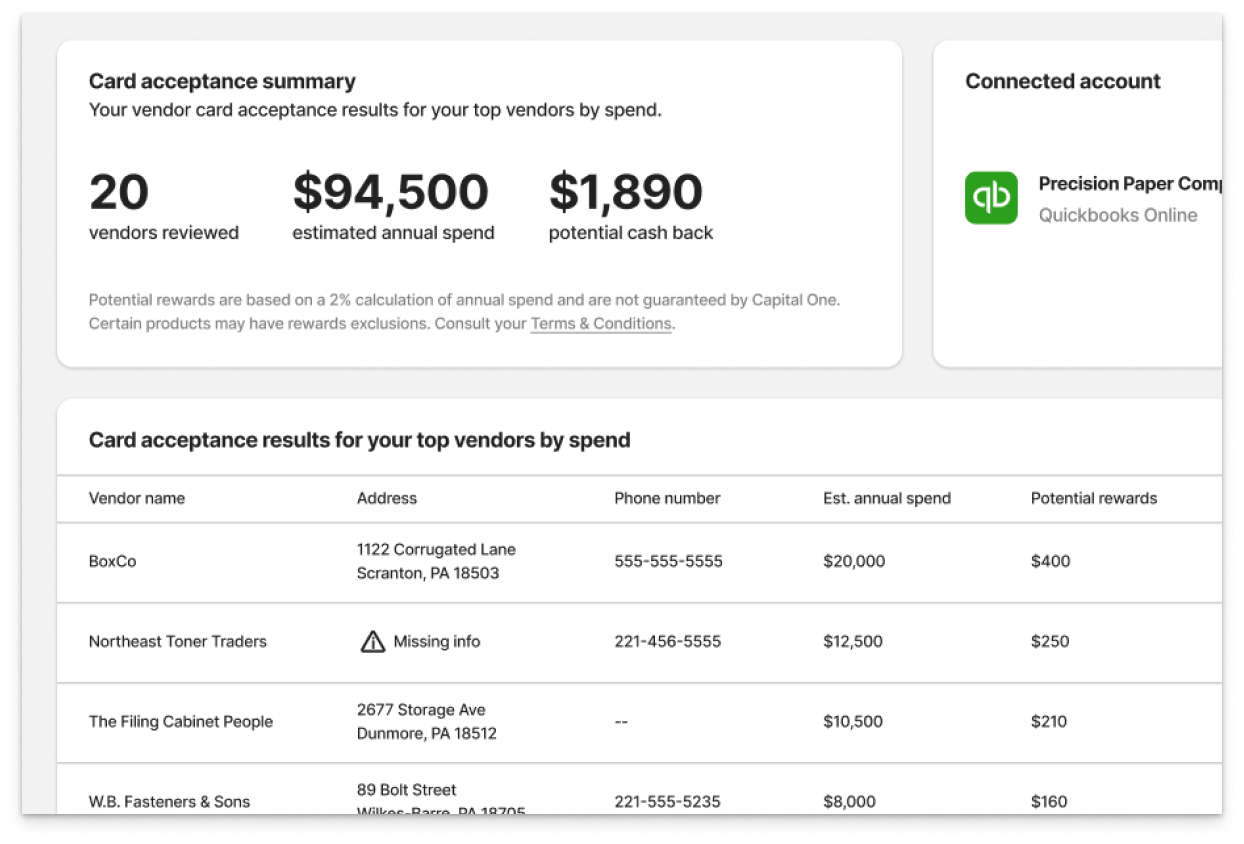

Incomplete data

⚠️ Problem: The extent to which vendor data is complete in Quickbooks varies across businesses, resulting in missing vendor data. Without complete vendor data, we cannot generate card acceptance results.

🧠 Solution:

Display a clear warning within the results table to communicate the issue to customers and provide clear instructions on how to rectify.

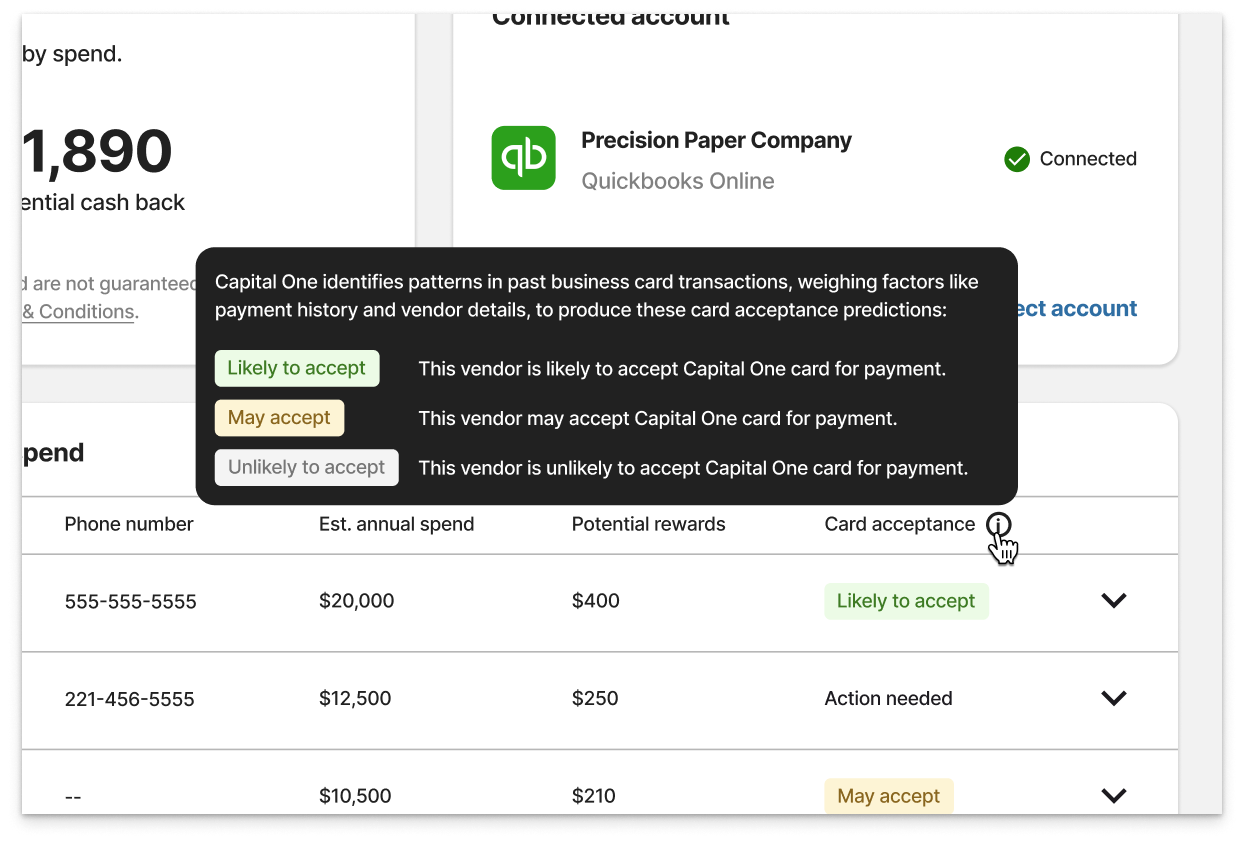

Communicating results

⚠️ Problem:

Customers may question the predictive nature of these results. How do we clearly and succinctly explain the card acceptance statuses and where is this info best surfaced?

🧠 Solution:

I conducted user testing to assess the performance of a legend in the top-right of the results page. Since many users skimmed over or ignored it, we created a tooltip to store this information and keep the focus on the vendor table.